Buy-To-Let Taxation Changes

Buy-To-Let Taxation

Those who invest in buy-to-let properties can benefit from a range of changes to the buy-to-let taxation rules. Since the introduction of the Basic Rate of tax in April 2013, landlords have been able to use tax relief to lower their property costs. However, this change could come at a cost as the reduction in the personal allowance and the loss of the personal savings allowance could make the basic rate of tax a burden.

New rules are in place for buy-to-let investors that may leave many of them with higher tax bills. The introduction of the basic rate of tax will only apply to the first four years of your buy-to-let investment. The change will result in the increase in property profits, resulting in increased income and higher rate taxes, and a whole host of other potential tax traps. While there are numerous benefits to be gained by investing in buy-to-let properties, it is crucial to make the right choice for you.

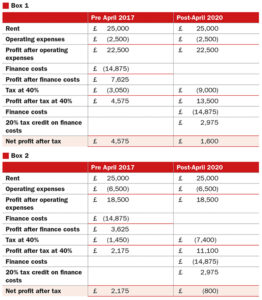

The first major change in the buy-to-let taxation rules is the restriction on mortgage interest relief. This measure came into effect in April 2020, and restricts all income tax relief on property finance costs to 20%. This means that if you have more than two rental properties in your portfolio, you will have to pay a higher rate of tax, which will further raise your tax bill. It is important to remember that the restrictions are temporary. The new laws do not apply to Buy-to-let properties in the future.

Buy-To-Let Taxation Changes

The new rules on buy-to-let taxation are intended to help landlords maximize their profits. The current rates of taxation have reduced capital gains tax allowances, allowing investors to deduct their business expenses like mortgage interest. The changes also result in a decrease in the overall amount of taxes that are owed. The changes will help those who own second homes to realize a profit on their investment. A new rule will ensure that those who invest in buy-to-let properties are paying their fair share of taxes.

The new tax legislation also makes it harder for landlords to save for property taxes. For instance, the tax on residential property finance costs will be restricted to the basic rate of tax for the next four years. While this will not necessarily impact rental income, it will increase landlords’ property profits and increase their income. In addition, the changes also affect the deduction of capital gains for taxable properties. There are other factors that are worth considering.

The new buy-to-let tax legislation will make it more complicated to claim the reliefs that were previously available for landlords. Despite the fact that the changes will not affect those who invest in buy-to-let properties, the income of the landlords will be subject to income tax. The change will also affect the landlord’s capital gains. This is a crucial step for those who want to own a property in the UK.